Borrowell is a financial technology company that provides credit products and services to help Canadians improve their financial health. We offer free credit scores, reports and tools to help you better understand and manage your credit. It also provides personal loans, small business loans and lines of credit products. In this article, we will be taking a look at some of the best financial tips from Borrowell. From saving money to investing and everything in between, these tips will help you make the most of your money.

Our mission is to help Canadians make great decisions about their money. We do this by giving them the information and tools they need to make informed financial decisions.

We are committed to helping you improve your financial health and reach your goals.

These are some of the financial tips that Borrowell offers!

Borrowell offers a variety of financial tips to help you save money and make the most of your money. Here are some of their top tips:

1. How to get your free credit score now.

2. Choose the best Credit Card for you to use.

3. Borrowell provides you how to get personal loan you need

4. Find The Right Personal Bank Account For You

Let's find out how Borrowell can help you find the right bank to finance your next purchase, investment, or dream project. So let's talk about how you can take advantage of Canada’s free credit score and stay on top of your current finances.

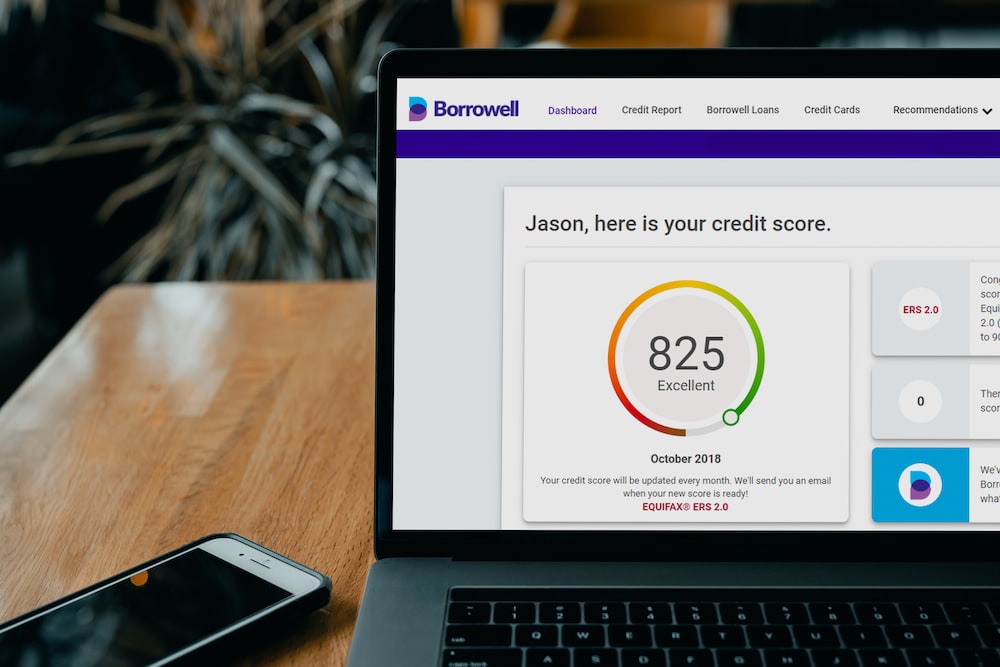

Get your free credit score now!

There are a few different ways to get your free credit score in Canada. You can sign up in Borrowell for a free credit score service.

If you sign up for a free credit score service like Borrowell, you will be able to see your credit score and credit report for free. You will also be able to track your progress over time and see how your credit score changes.

If you want to take control of your finances for the future, sign up for Borrowell and get a free credit score! You'll join over two million Canadians who use our service to get important tools for understanding and managing their credit. And checking your score won't hurt it since we don’t pull any information from Equifax, Experian, or Transunion.

Choose the best credit card for you

Credit cards can be a great way to earn rewards, build your credit history, and manage your finances. But with so many different cards out there, it can be hard to know which one is right for you.

Here are a few things to consider when choosing a credit card:

1. What are your goals? Do you want to earn rewards, build your credit history, or both?

2. What are the fees and interest rates? Make sure you understand all the fees and interest rates associated with the card before you apply.

3. What is the credit limit? The credit limit is the maximum amount you can charge on the card. This is something to consider if you plan on using the card for large purchases.

4. How easy is it to use? Some cards have complicated rewards programs or require good credit to qualify. Make sure you choose a card that fits your lifestyle and financial needs.

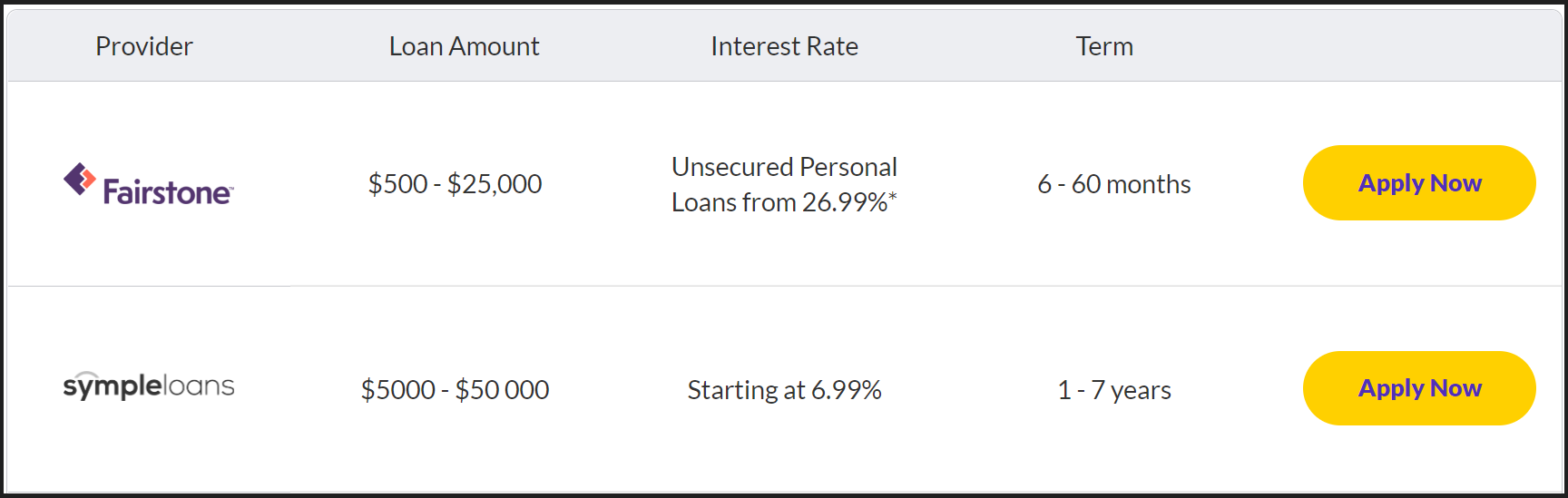

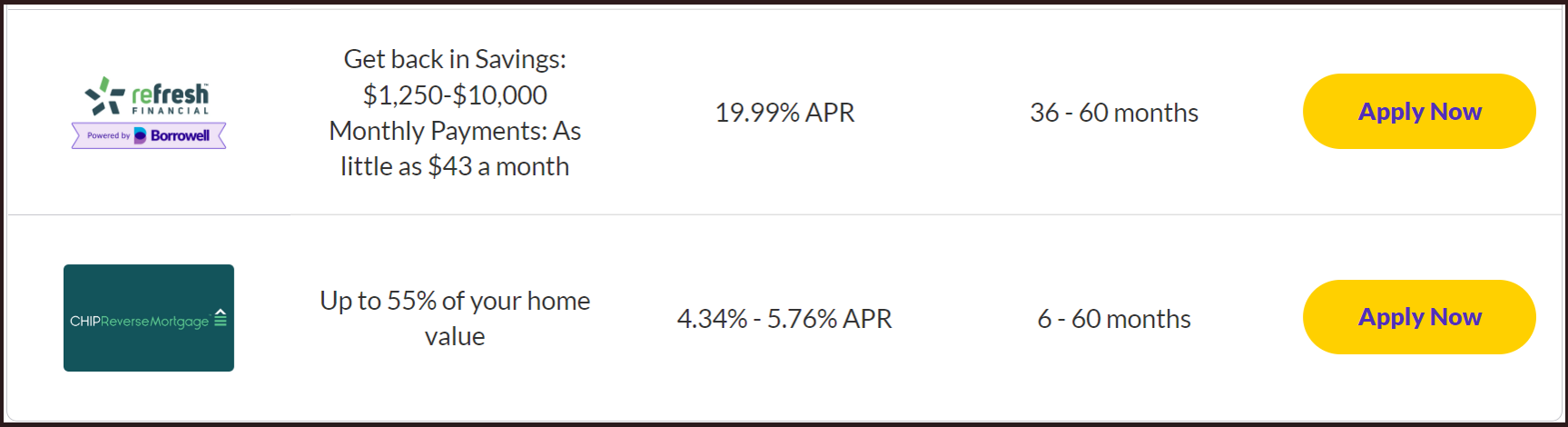

Get the Personal Loan you need

Get the funds you need to make your next big purchase. We offer competitive interest rates and flexible repayment terms on personal loans of up to $35,000.

Get pre-approved in minutes

Use our online application to get pre-approved in minutes. We’ll work with you to find a loan that fits your budget and your needs.

Make your payments on time

We understand that life happens. That’s why we offer flexible repayment options and the ability to make early payments without penalty.

Find The Right Personal Bank Account For You

Borrowell offers a variety of personal banking products and services to help you manage your finances. From savings and chequing accounts to loans and lines of credit, we have the right solution for you. Our team of experts can help you find the best way to use our products and services to reach your financial goals.

Paying bills and managing your expenses is a big responsibility that starts with knowing how to fund your account. Do you know which account is best for you?

With Borrowell, it's quick and easy to find the best chequing and savings accounts around.

To help you, we use technology and expertise to recommend the products that are best suited to your financial profile.

We know how important it is to make sure you get the data and features that are right for your business. That's why we offer detailed information about account features and limited-time promotions. The team will provide you with valuable insight, so no more guessing!

How can Borrowell help me with my finances?

Borrowell is a financial technology company that offers free credit scores and reports, personal loans, and other financial products.

Borrowell can help you with your finances by providing you with a free credit score and report, personal loans, and other financial products.

Borrowell can help you understand your credit score and report, identify opportunities to improve your credit, and access personal loans with competitive rates.

Visit Borrowell's website to learn more about how they can help you with your finances.

How can I get started with Borrowell?

If you're looking to take control of your finances, Borrowell is a great place to start. We offer free credit scores, credit reports and financial tools to help you make informed decisions about your money.

Here's how you can get started with Borrowell:

1. Sign up for a free account

2. Check your credit score and credit report

3. Use our financial tools to help you make informed decisions about your money

4. Stay on top of your finances with our weekly email newsletter

Conclusion

We hope you found these financial tips from Borrowell useful! If you're looking to save money, it's important to be diligent and creative with your finances. Try out a few of these tips and see how much you can save. Remember, every little bit counts when it comes to saving for your future.