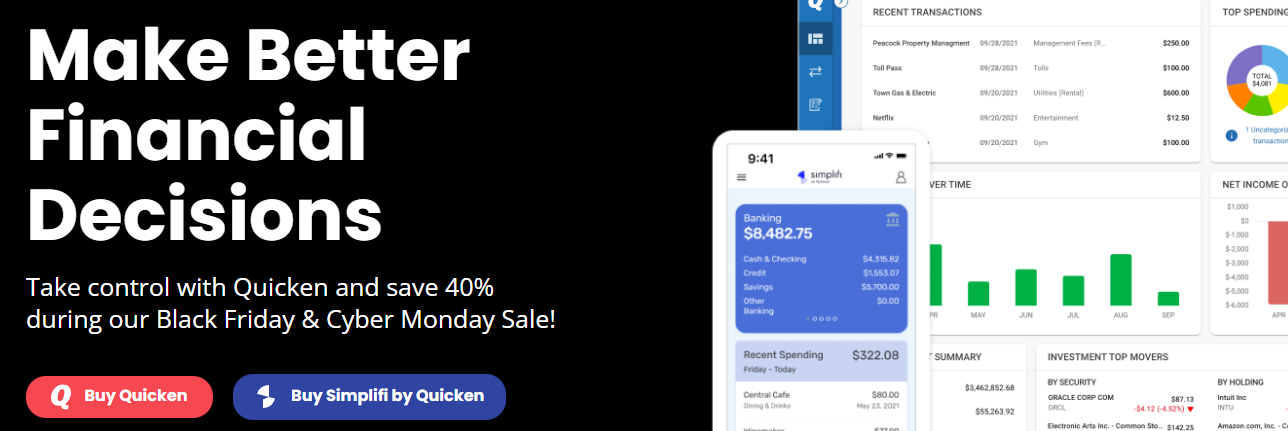

Quicken is one of the most popular personal finance software packages on the market. It’s a great tool for tracking your finances and making better decisions. In this blog post, we will review Quicken and give you our take on its features and benefits. We’ll also outline some of the downsides and provide some tips on how to make the most of Quicken in your own financial planning.

What is Quicken?

Quicken is software designed to help personal finance managers keep track of their finances and make informed decisions. Quicken helps users stay organized and in control of their money, whether they are managing a single account or multiple accounts across different banks and financial institutions. Quicken also offers powerful features for budgeting and tracking spending. Quicken is available in a variety of platforms, including Windows, Mac, iOS, Android, and the web. In addition to its desktop software, Quicken offers mobile apps for both Android and iOS devices. The app allows users to manage their finances on the go, without having to leave the comfort of their home or office. Quicken also offers a variety of plugins that allow you to integrate with other applications and websites. Overall, Quicken is an essential tool for managing personal finance. It provides an intuitive interface that is easy to use, and its plethora of features make it versatile enough for any need.

Quicken is software designed to help personal finance managers keep track of their finances and make informed decisions. Quicken helps users stay organized and in control of their money, whether they are managing a single account or multiple accounts across different banks and financial institutions. Quicken also offers powerful features for budgeting and tracking spending. Quicken is available in a variety of platforms, including Windows, Mac, iOS, Android, and the web. In addition to its desktop software, Quicken offers mobile apps for both Android and iOS devices. The app allows users to manage their finances on the go, without having to leave the comfort of their home or office. Quicken also offers a variety of plugins that allow you to integrate with other applications and websites. Overall, Quicken is an essential tool for managing personal finance. It provides an intuitive interface that is easy to use, and its plethora of features make it versatile enough for any need.

Some of the key features

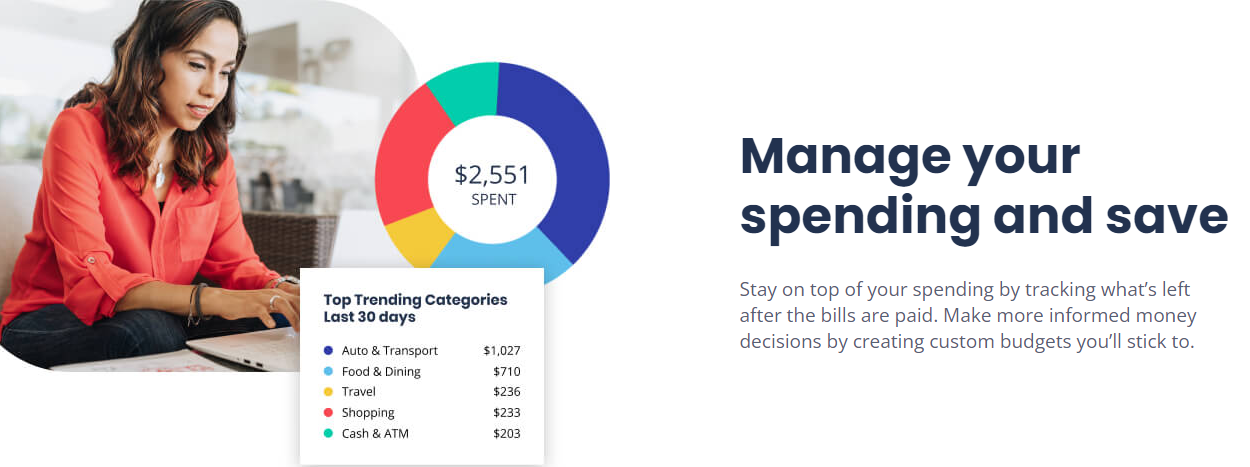

Quicken is a powerful personal finance software that offers users a variety of features to help them manage their money. Some of the most popular features include: budgeting, tracking expenses, creating financial goals, and receiving automatic updates.

– One of the most popular features of Quicken is its budgeting functionality. This feature allows users to create budgets and track their spending against those budgets over time. This helps users identify where they can cut back on their expenses and save money.

– Another great feature of Quicken is its ability to track expenses. This feature allows users to keep track of what they are spending and where the money is going. This information can be helpful in identifying where money can be saved and used for other purposes.

– Lastly, one of the main benefits of using Quicken is its ability to automatically update the software. This means that users will always have the latest changes made to the software available to them. This makes it easy for users to stay up-to-date on their finances and make sure that they are taking advantage of all of the available opportunities.

Plans & Pricing

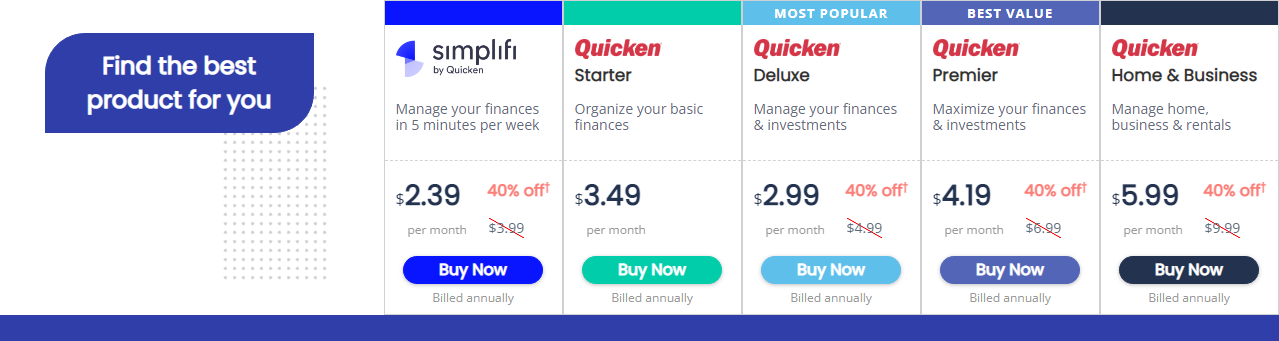

Quicken is a popular personal finance software that lets users keep track of their finances in a variety of ways. The plans and pricing of Quicken depend on the version you purchase, but all versions offer a variety of features and options.

Quicken Starter: The basic Quicken plan offers all the basic features needed to manage your finances. This plan includes an account overview, budgeting tools, and income and expense tracking. You can also customize your account settings and add notes to important transactions. The Quicken Starter plan costs $3.49 per month billed annually.

Quicken Deluxe: If you want more features than the basic plan offers, the Deluxe plan is for you. The Deluxe plan includes extra account types (such as a joint checking account), more budgeting tools, and enhanced tracking capabilities. You also have the option to add notes to important transactions, create custom reports, and password protect your account. The Deluxe plan costs $4.99 per month billed annually.

Quicken Premier: This plan is a great option for people who want to take care of their finances in a more organized and simplified way. They include features like budgeting tools, automatic bill payments, and investments. Quicken Premier Plan starts at $6.99 per month billed annually. If you want to add more features or services, you can upgrade to a higher plan, which starts at $9.99 per month billed annually.

Quicken Home & Business: If you need even more features than the Deluxe plan offers, the Home & Business plan is for you. The Home & Business plan includes everything in the Deluxe plan plus online banking access and support for up to ten users. The Home & Business plan costs $9.99 per month billed annually.

Resources available at Quicken

At Quicken, they know that you have a lot of options when it comes to financial tools. That’s why they've compiled a list of resources that we think will help you stay on top of your finances.

Budget Calculator

Quicken's budget calculator is a great tool for keeping track of your expenses and planning for future savings. You can use the calculator to find out how much you need to save each month in order to reach your financial goals, or to figure out how much money you can spend each month without going over your budget. The calculator also allows you to create budgets based on different income levels, so you can see exactly how your spending will change if your income increases or decreases. The Quicken budget calculator is easy to use, and it will help you stay on track with your finances. If you're looking for a way to improve your financial management skills, the Quicken budget calculator is a great tool to consider.

Vacation Calculator

Are you wondering how much money you'll need for your upcoming Quicken vacation? Thanks to our handy Quicken Vacation Calculator, you can easily estimate costs before you leave. Just enter the length of your trip and the number of nights you'll be staying, and we'll give you a breakdown of how much money you'll need for food, transportation, lodging, and more. We also include tips on maximizing your budget and saving on expenses. So go ahead and plan your dream vacation with Quicken Vacation Calculator!

Retirement Calculator

If you're thinking about retirement, Quicken can help. The Quicken Retirement Calculator can help you estimate how much money you'll need to have saved for a comfortable retirement. You can also use the calculator to see how your savings are growing over time. It's easy to use, and it's free. To use the Quicken Retirement Calculator, first enter your age and gender. Next, choose your marital status and number of dependents. Finally, enter information about your income and expenses. The calculator will then tell you how much money you'll need to have saved for a comfortable retirement. Quicken also provides helpful tips on saving for retirement. For instance, you can set up automatic deposits into your savings account, or borrow against your home equity to save more money. Quicken also offers a variety of retirement planning tools, including a retirement budget and a reverse mortgage calculator. With these tools, you can create a plan for retiring on your own terms—whatever that may be.

How to start making better financial decisions?

If you're considering using Quicken to manage your finances, there are a few things to know before getting started.

– The first step is to create a Quicken account. Once you have an account, you can sign in to begin setting up your account. To get started, you'll need to provide some basic information about yourself. This includes your name, address, and bank information.

– You'll also need to decide what type of account you want to use Quicken with. There are three options available: a checking account, a savings account, or a credit card account.

– Once you've set up your account, you'll need to identify all of the financial accounts that are relevant to your life. This includes everything from your checking and savings accounts to your investments and credit cards.

– Once you have all of your information ready, it's time to start organizing it into categories. You can do this by creating tabs on the left side of the main window or by using templates that Quicken provides.

– Quicken also lets you track your expenses and income in detail. You can see which bills are due next, how much money you have left in each category, and how much debt you have overall. You can also see which bills are costing more than usual and make adjustments accordingly.

Overall, using Quicken is an easy way to manage your finances and stay on top of your spending habits. If you're new to the process

Customer Support at Quicken

Quicken is one of the most popular personal finance software applications on the market, and for good reason. Quicken offers a comprehensive set of features to help users manage their finances. One of the most important features of Quicken is customer support. Quicken provides 24/7 support through its website and phone line. If you need help with your Quicken account, the team at Quicken is always happy to assist. In addition to its customer support, Quicken also offers tutorials and guides to help users get the most out of its features. If you ever have any questions or problems setting up or using Quicken, be sure to check out the company's website or call toll-free number for assistance.

Conclusion

Quicken is a comprehensive financial management program that allows users to track their bank and credit card accounts, manage their investments, and keep tabs on their spending. Quicken also offers a wealth of other features, such as budgeting tools, debt reduction advice, and automatic tax planning. If you're looking for a comprehensive financial management solution, Quicken should definitely be on your list.